В этом руководстве вы узнаете, как использовать оператор SQL Server UPDATE для изменения существующих данных в таблице.

Введение в оператор SQL Server UPDATE

Чтобы изменить существующие данные в таблице, используйте следующий оператор UPDATE:

UPDATE

table_name

SET

c1 = v1,

c2 = v2,

...,

cn = vn

[WHERE condition]

В этом синтаксисе:

- Сначала укажите имя таблицы, данные которой вы хотите обновить, после ключевого слова UPDATE.

- Во-вторых, укажите список столбцов c1, c2, …, cn и новые значения v1, v2, … vn в предложении SET.

- В-третьих, отфильтруйте строки для обновления, указав условие в предложении WHERE. Предложение WHERE необязательно. Если вы пропустите предложение WHERE, оператор обновит все строки в таблице.

Примеры ОБНОВЛЕНИЯ SQL Server

Сначала создайте новую таблицу под названием «Налоги» для демонстрации.

CREATE TABLE sales.taxes( tax_id INT PRIMARY KEY IDENTITY(1, 1), state VARCHAR(50) NOT NULL UNIQUE, state_tax_rate DEC(3, 2), avg_local_tax_rate DEC(3, 2), combined_rate AS state_tax_rate + avg_local_tax_rate, max_local_tax_rate DEC(3, 2), updated_at datetime );

Во-вторых, выполните следующие операторы для вставки данных в таблицу налогов:

Вставьте заявления

INSERT INTO sales.taxes(state,state_tax_rate,avg_local_tax_rate,max_local_tax_rate) VALUES('Alabama',0.04,0.05,0.07);

INSERT INTO sales.taxes(state,state_tax_rate,avg_local_tax_rate,max_local_tax_rate) VALUES('Alaska',0,0.01,0.07);

INSERT INTO sales.taxes(state,state_tax_rate,avg_local_tax_rate,max_local_tax_rate) VALUES('Arizona',0.05,0.02,0.05);

INSERT INTO sales.taxes(state,state_tax_rate,avg_local_tax_rate,max_local_tax_rate) VALUES('Arkansas',0.06,0.02,0.05);

INSERT INTO sales.taxes(state,state_tax_rate,avg_local_tax_rate,max_local_tax_rate) VALUES('California',0.07,0.01,0.02);

INSERT INTO sales.taxes(state,state_tax_rate,avg_local_tax_rate,max_local_tax_rate) VALUES('Colorado',0.02,0.04,0.08);

INSERT INTO sales.taxes(state,state_tax_rate,avg_local_tax_rate,max_local_tax_rate) VALUES('Connecticut',0.06,0,0);

INSERT INTO sales.taxes(state,state_tax_rate,avg_local_tax_rate,max_local_tax_rate) VALUES('Delaware',0,0,0);

INSERT INTO sales.taxes(state,state_tax_rate,avg_local_tax_rate,max_local_tax_rate) VALUES('Florida',0.06,0,0.02);

INSERT INTO sales.taxes(state,state_tax_rate,avg_local_tax_rate,max_local_tax_rate) VALUES('Georgia',0.04,0.03,0.04);

INSERT INTO sales.taxes(state,state_tax_rate,avg_local_tax_rate,max_local_tax_rate) VALUES('Hawaii',0.04,0,0);

INSERT INTO sales.taxes(state,state_tax_rate,avg_local_tax_rate,max_local_tax_rate) VALUES('Idaho',0.06,0,0.03);

INSERT INTO sales.taxes(state,state_tax_rate,avg_local_tax_rate,max_local_tax_rate) VALUES('Illinois',0.06,0.02,0.04);

INSERT INTO sales.taxes(state,state_tax_rate,avg_local_tax_rate,max_local_tax_rate) VALUES('Indiana',0.07,0,0);

INSERT INTO sales.taxes(state,state_tax_rate,avg_local_tax_rate,max_local_tax_rate) VALUES('Iowa',0.06,0,0.01);

INSERT INTO sales.taxes(state,state_tax_rate,avg_local_tax_rate,max_local_tax_rate) VALUES('Kansas',0.06,0.02,0.04);

INSERT INTO sales.taxes(state,state_tax_rate,avg_local_tax_rate,max_local_tax_rate) VALUES('Kentucky',0.06,0,0);

INSERT INTO sales.taxes(state,state_tax_rate,avg_local_tax_rate,max_local_tax_rate) VALUES('Louisiana',0.05,0.04,0.07);

INSERT INTO sales.taxes(state,state_tax_rate,avg_local_tax_rate,max_local_tax_rate) VALUES('Maine',0.05,0,0);

INSERT INTO sales.taxes(state,state_tax_rate,avg_local_tax_rate,max_local_tax_rate) VALUES('Maryland',0.06,0,0);

INSERT INTO sales.taxes(state,state_tax_rate,avg_local_tax_rate,max_local_tax_rate) VALUES('Massachusetts',0.06,0,0);

INSERT INTO sales.taxes(state,state_tax_rate,avg_local_tax_rate,max_local_tax_rate) VALUES('Michigan',0.06,0,0);

INSERT INTO sales.taxes(state,state_tax_rate,avg_local_tax_rate,max_local_tax_rate) VALUES('Minnesota',0.06,0,0.01);

INSERT INTO sales.taxes(state,state_tax_rate,avg_local_tax_rate,max_local_tax_rate) VALUES('Mississippi',0.07,0,0.01);

INSERT INTO sales.taxes(state,state_tax_rate,avg_local_tax_rate,max_local_tax_rate) VALUES('Missouri',0.04,0.03,0.05);

INSERT INTO sales.taxes(state,state_tax_rate,avg_local_tax_rate,max_local_tax_rate) VALUES('Montana',0,0,0);

INSERT INTO sales.taxes(state,state_tax_rate,avg_local_tax_rate,max_local_tax_rate) VALUES('Nebraska',0.05,0.01,0.02);

INSERT INTO sales.taxes(state,state_tax_rate,avg_local_tax_rate,max_local_tax_rate) VALUES('Nevada',0.06,0.01,0.01);

INSERT INTO sales.taxes(state,state_tax_rate,avg_local_tax_rate,max_local_tax_rate) VALUES('New Hampshire',0,0,0);

INSERT INTO sales.taxes(state,state_tax_rate,avg_local_tax_rate,max_local_tax_rate) VALUES('New Jersey',0.06,0,0);

INSERT INTO sales.taxes(state,state_tax_rate,avg_local_tax_rate,max_local_tax_rate) VALUES('New Mexico',0.05,0.02,0.03);

INSERT INTO sales.taxes(state,state_tax_rate,avg_local_tax_rate,max_local_tax_rate) VALUES('New York',0.04,0.04,0.04);

INSERT INTO sales.taxes(state,state_tax_rate,avg_local_tax_rate,max_local_tax_rate) VALUES('North Carolina',0.04,0.02,0.02);

INSERT INTO sales.taxes(state,state_tax_rate,avg_local_tax_rate,max_local_tax_rate) VALUES('North Dakota',0.05,0.01,0.03);

INSERT INTO sales.taxes(state,state_tax_rate,avg_local_tax_rate,max_local_tax_rate) VALUES('Ohio',0.05,0.01,0.02);

INSERT INTO sales.taxes(state,state_tax_rate,avg_local_tax_rate,max_local_tax_rate) VALUES('Oklahoma',0.04,0.04,0.06);

INSERT INTO sales.taxes(state,state_tax_rate,avg_local_tax_rate,max_local_tax_rate) VALUES('Oregon',0,0,0);

INSERT INTO sales.taxes(state,state_tax_rate,avg_local_tax_rate,max_local_tax_rate) VALUES('Pennsylvania',0.06,0,0.02);

INSERT INTO sales.taxes(state,state_tax_rate,avg_local_tax_rate,max_local_tax_rate) VALUES('Rhode Island',0.07,0,0);

INSERT INTO sales.taxes(state,state_tax_rate,avg_local_tax_rate,max_local_tax_rate) VALUES('South Carolina',0.06,0.01,0.02);

INSERT INTO sales.taxes(state,state_tax_rate,avg_local_tax_rate,max_local_tax_rate) VALUES('South Dakota',0.04,0.01,0.04);

INSERT INTO sales.taxes(state,state_tax_rate,avg_local_tax_rate,max_local_tax_rate) VALUES('Tennessee',0.07,0.02,0.02);

INSERT INTO sales.taxes(state,state_tax_rate,avg_local_tax_rate,max_local_tax_rate) VALUES('Texas',0.06,0.01,0.02);

INSERT INTO sales.taxes(state,state_tax_rate,avg_local_tax_rate,max_local_tax_rate) VALUES('Utah',0.05,0,0.02);

INSERT INTO sales.taxes(state,state_tax_rate,avg_local_tax_rate,max_local_tax_rate) VALUES('Vermont',0.06,0,0.01);

INSERT INTO sales.taxes(state,state_tax_rate,avg_local_tax_rate,max_local_tax_rate) VALUES('Virginia',0.05,0,0);

INSERT INTO sales.taxes(state,state_tax_rate,avg_local_tax_rate,max_local_tax_rate) VALUES('Washington',0.06,0.02,0.03);

INSERT INTO sales.taxes(state,state_tax_rate,avg_local_tax_rate,max_local_tax_rate) VALUES('West Virginia',0.06,0,0.01);

INSERT INTO sales.taxes(state,state_tax_rate,avg_local_tax_rate,max_local_tax_rate) VALUES('Wisconsin',0.05,0,0.01);

INSERT INTO sales.taxes(state,state_tax_rate,avg_local_tax_rate,max_local_tax_rate) VALUES('Wyoming',0.04,0.01,0.02);

INSERT INTO sales.taxes(state,state_tax_rate,avg_local_tax_rate,max_local_tax_rate) VALUES('D.C.',0.05,0,0);

1) Обновить один столбец во всех строках таблицы

Следующий оператор использует оператор UPDATE для изменения значений столбца updated_at в таблице налогов на системную дату и время:

UPDATE sales.taxes SET updated_at = GETDATE();

Выход:

(51 rows affected)

Вывод показывает, что 51 строка была успешно обновлена.

Давайте проверим обновление:

SELECT * FROM sales.taxes;

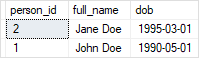

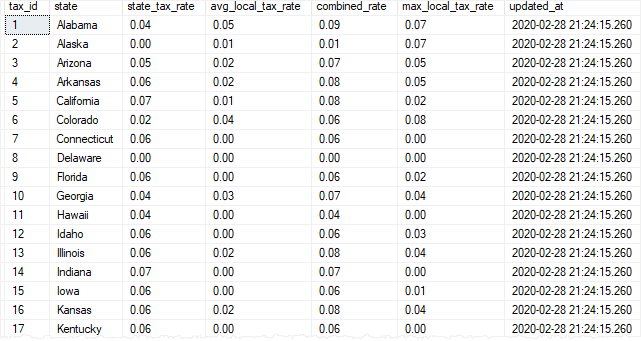

Вот частичный вывод:

Вывод показывает, что столбец updated_at был обновлен с указанием даты и времени выполнения оператора.

2) Обновить несколько столбцов

Следующее утверждение увеличивает максимальную ставку местного налога на 2%, а среднюю ставку местного налога на 1% в штатах, где максимальная ставка местного налога составляет 1%.

UPDATE sales.taxes

SET max_local_tax_rate += 0.02,

avg_local_tax_rate += 0.01

WHERE

max_local_tax_rate = 0.01;

Выход:

(7 rows affected)

Вывод показывает, что налоги 7 штатов были обновлены.

Краткое содержание

- Используйте оператор SQL Server UPDATE для изменения данных в существующей таблице.